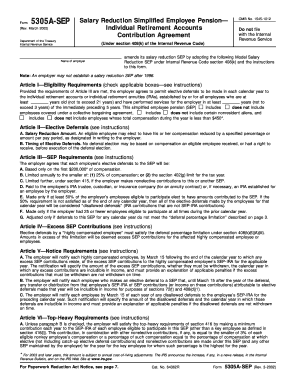

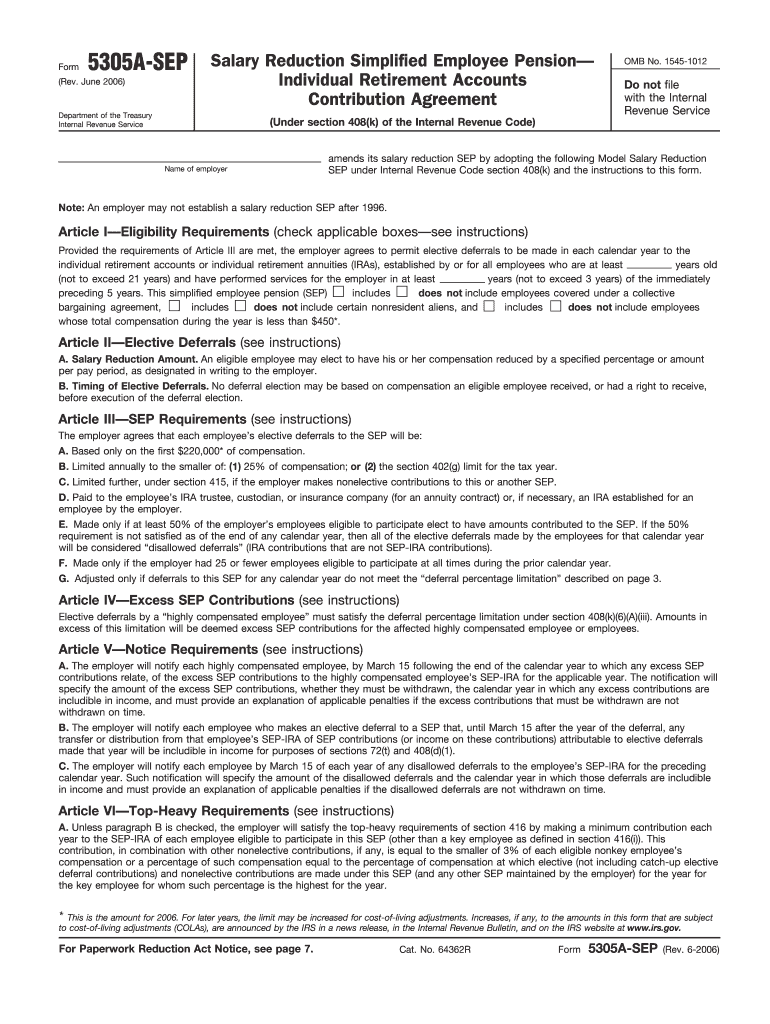

IRS 5305A-SEP 2006-2024 free printable template

Show details

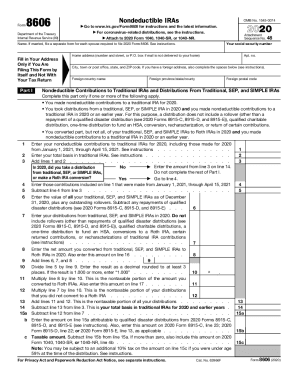

See Form 8606. Also you may want to see Pub. 590. SEP-IRA Amounts Rollover or Transfer To Another IRA you may not withdraw or transfer from your SEP-IRA any SEP contributions or income on 1. Thus the excess SEP reportable in Part III of Form 5329 for each year the contributions remain in your IRA. You may not however roll over or transfer excess elective deferrals excess SEP your SEP-IRA to another IRA. Excess Amounts There are three situations which will result in excess amounts in a salary...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your sep ira 2006-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sep ira 2006-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sep ira online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sep ira set up deadline form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IRS 5305A-SEP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sep ira 2006-2024 form

How to fill out SEP IRA:

01

Gather necessary information: Collect your Social Security number, business information, and relevant financial documents such as income statements and tax returns.

02

Choose a financial institution: Select a bank, brokerage firm, or mutual fund company that offers SEP IRA accounts.

03

Open the account: Provide the required documents, complete the application, and deposit the minimum required amount to open the account.

04

Choose your investments: Determine the investment options offered by your chosen financial institution and select the ones that align with your investment goals and risk tolerance.

05

Determine employee eligibility: Review the IRS guidelines to determine which of your employees are eligible to participate in the SEP IRA plan.

06

Calculate and contribute contributions: Use the IRS guidelines to calculate the maximum allowable contribution for each eligible employee. Make the contributions to their SEP IRA accounts.

07

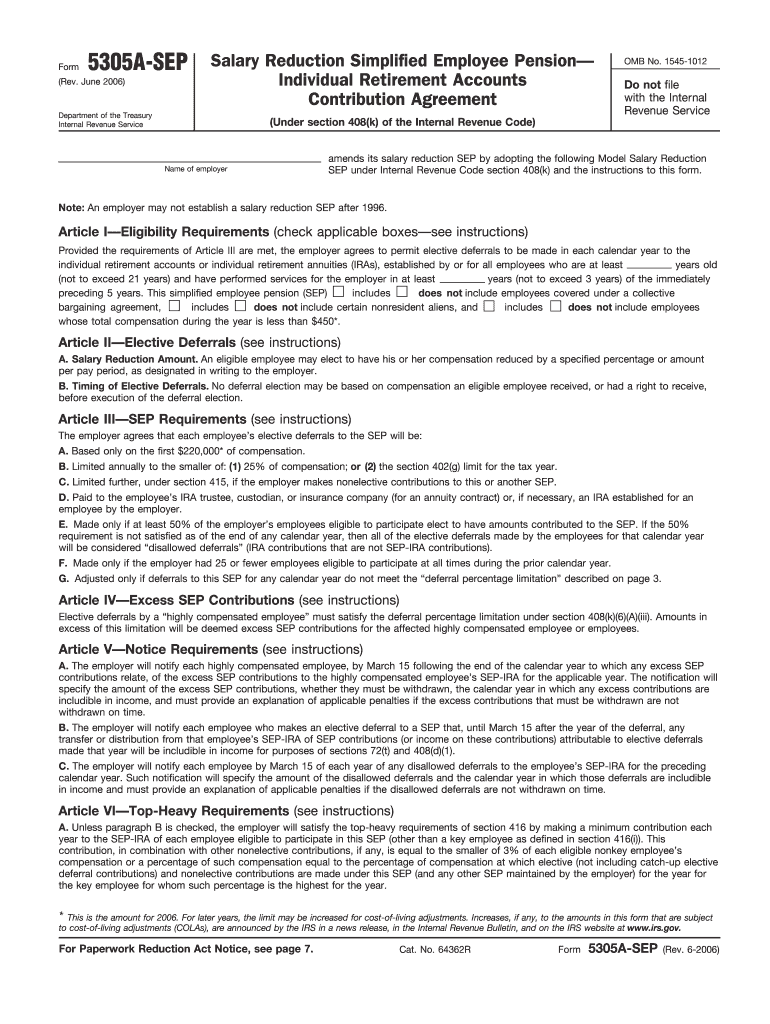

Report contributions: Fill out the necessary forms, such as Form 5305-SEP or Form 5305A-SEP, to report your SEP IRA contributions to the IRS.

08

Maintain records: Keep detailed records of all SEP IRA contributions, employee eligibility, and other relevant documentation for future reference and potential audits.

Who needs SEP IRA:

01

Self-Employed Individuals: SEP IRA is particularly suitable for self-employed individuals, freelancers, and independent contractors who want to save for retirement while enjoying tax advantages.

02

Small Business Owners: SEP IRA is an excellent retirement savings option for small business owners who want to provide their employees with a retirement plan while maintaining flexibility in contribution amounts.

03

Employees of Eligible Employers: Employees of businesses that offer SEP IRA plans are eligible to participate and can benefit from the employer contributions made on their behalf.

Video instructions and help with filling out and completing sep ira

Instructions and Help about 5305a sep form

Fill irs form 5305a sep : Try Risk Free

People Also Ask about sep ira

Is Form 5500 required for SEP IRA?

Can I set up a SEP IRA for myself?

Is there a tax form for SEP IRA?

Can I have a SEP IRA if I have no employees?

What form do I need to set up a SEP IRA?

Can I open a SEP IRA for just myself?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out sep ira?

1. Speak to your accountant or financial advisor to determine if a SEP IRA is the best retirement savings option for you.

2. Establish a SEP IRA with a financial institution of your choice, and determine the amount you want to contribute to your account.

3. Fill out the forms provided by the financial institution to set up the SEP IRA. This includes personal information such as name, address, Social Security number, date of birth, employer ID number, bank account information, and beneficiary information.

4. Decide on the contributions you want to make to the SEP IRA. Contributions are generally made in the form of a percentage of your income, or a fixed dollar amount.

5. File a Form 5305-SEP with the IRS to establish the SEP IRA. This form will need to be filed annually to maintain the SEP IRA account.

6. Make contributions to the SEP IRA each year to take advantage of the tax benefits associated with the account.

7. Monitor the performance of the investments in your SEP IRA and make adjustments as needed.

What information must be reported on sep ira?

A SEP IRA must report the amount of contributions, earnings, and withdrawals, as well as the name and address of the owner, the name and address of the trustee or custodian, and the date of each contribution and withdrawal. It must also provide documentation of the annual contributions made to the plan, along with the name and address of the employer(s) whose contributions were made. The SEP IRA must also provide information on the total amount of contributions made to the plan in the current year and the total amount of contributions made in the prior year.

What is sep ira?

SEP IRA stands for Simplified Employee Pension Individual Retirement Account. It is a type of retirement savings plan that allows self-employed individuals and small business owners to contribute and save for retirement in a tax-advantaged manner. Contributions are made by the employer and are tax-deductible, and the funds in the account grow on a tax-deferred basis. SEP IRAs can be established by businesses of any size, including sole proprietorships, partnerships, and corporations. The contributions made to the SEP IRA are generally based on a percentage of the employee's compensation, up to certain limits set by the IRS.

Who is required to file sep ira?

Any business owner or self-employed individual who has established a Simplified Employee Pension (SEP) IRA is required to file a SEP IRA.

What is the purpose of sep ira?

The purpose of a SEP IRA (Simplified Employee Pension Individual Retirement Account) is to provide self-employed individuals and small business owners with a retirement savings plan. It allows them to contribute and potentially deduct contributions to their own retirement account, as well as make contributions on behalf of their eligible employees. The primary benefits of a SEP IRA are:

1. Tax Advantages: Contributions made to a SEP IRA are tax-deductible for both the employer and the employee. The funds in the account grow tax-deferred until withdrawal in retirement, allowing for potential tax savings.

2. Flexible Contributions: Employers have the flexibility to decide on the contribution amounts each year, which can vary based on business profits. They can contribute up to 25% of eligible employees' compensation or a maximum annual limit set by the IRS.

3. Easy Administration: SEP IRAs have simpler administration and lower administrative costs compared to other retirement plans such as 401(k)s. There are no annual filings required, and employers can easily set up and maintain accounts.

4. Employee Attractiveness: Offering a SEP IRA can be an attractive benefit for small businesses to attract and retain talented employees. Employees receive retirement savings opportunities and potential tax benefits without contributing their own funds.

5. Retirement Savings: The main purpose of a SEP IRA is to help individuals accumulate funds for retirement. The contributions and potential investment earnings build over time to provide individuals with a nest egg to support their financial goals during retirement.

It is important to consult with a financial advisor or tax professional to understand the specific rules and regulations surrounding SEP IRAs and how they align with your individual or business goals and circumstances.

When is the deadline to file sep ira in 2023?

The deadline to contribute to a SEP IRA (Simplified Employee Pension Individual Retirement Account) for a given tax year is typically the tax return filing deadline, including extensions. For the tax year 2022, the deadline to file taxes is April 15, 2023. However, it's important to note that tax deadlines can vary, and it's advisable to consult with a tax professional or the Internal Revenue Service (IRS) for the most accurate and up-to-date information.

What is the penalty for the late filing of sep ira?

The penalty for late filing of a SEP IRA (Simplified Employee Pension Individual Retirement Account) may vary depending on the specific circumstances and time period of the delay. However, generally, the Internal Revenue Service (IRS) imposes the following penalties:

1. Failure to file penalty: If the SEP IRA plan sponsor fails to file Form 5500 on time (due by the last day of the 7th month following the plan year-end), the IRS may impose a penalty of $250 per day, up to a maximum of $150,000.

2. Late contribution penalty: If contributions to the SEP IRA are made after the due date (including extensions) of the employer's income tax return (typically April 15), an excise tax of 10% may apply to the excess contribution.

It is important to note that penalties and fees may vary based on the specific circumstances and requirements outlined by the IRS. To ensure accurate information and advice, it is recommended to consult with a qualified tax professional or directly with the IRS.

How can I send sep ira for eSignature?

Once you are ready to share your sep ira set up deadline form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete irs form 5305 sep online?

With pdfFiller, you may easily complete and sign 5305a sep online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete form 5305 sep on an Android device?

Use the pdfFiller mobile app to complete your 5305 sep form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your sep ira 2006-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 5305 Sep is not the form you're looking for?Search for another form here.

Keywords relevant to form sep download

Related to irs employee retirement plans

If you believe that this page should be taken down, please follow our DMCA take down process

here

.